Learn how to outpace inflation and accelerate wealth creation with HDFC SKY, a cutting-edge discount-broking platform by HDFC Securities. Offering a wide range of investment options and innovative tools, including zero account-opening charges and lifetime free ETFs, it equips investors with the resources needed to achieve financial growth efficiently.

Understanding the Impact of Inflation on Your Finances

Inflation can have a significant impact on your finances, affecting your purchasing power, savings, investments, and overall financial well-being. As prices for goods and services rise due to inflation, the value of your money decreases, leading to a decrease in the real value of your savings and investments. For investors, inflation erodes the returns on investments, especially in fixed-income assets like bonds and savings accounts, as the nominal returns may not keep pace with the rising cost of living. It is crucial to consider the inflation rate when making financial decisions to ensure that your money is growing at a rate that outpaces inflation and preserves your purchasing power over time.

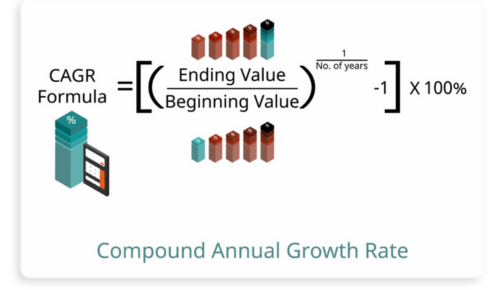

CAGR Calculator can be a valuable tool for understanding how your investments are performing relative to inflation. By calculating the compound annual growth rate of your investments, you can assess whether they are growing at a rate that outpaces inflation, thereby helping you maintain or enhance your purchasing power over time.

Understanding the impact of inflation on your finances is essential for effective financial planning and wealth management. By factoring in inflation when setting financial goals, creating budgets, and making investment decisions, you can better prepare for the long-term effects of rising prices. Adjusting your investment portfolio to include assets that have the potential to outperform inflation, such as equities, real estate, and commodities, can help you protect your wealth and achieve your financial objectives. Being aware of how inflation can erode the value of money over time allows you to make informed choices that safeguard your financial future and maintain your standard of living.

Strategies for Protecting Your Wealth Against Inflation

Protecting your wealth against inflation is crucial for long-term financial security. One effective strategy is to invest in assets that tend to increase in value at a rate higher than the inflation rate. This can include equities, real estate, and commodities. By diversifying your investment portfolio across different asset classes, you can mitigate the impact of inflation on your overall wealth. HDFC SKY, offered by HDFC Securities, provides a convenient platform for investing in Indian equities, ETFs, mutual funds, and other instruments, allowing you to access a wide range of investment options to protect your wealth against inflation.

Another strategy to safeguard your wealth against inflation is to consider investing in inflation-protected securities, such as Treasury Inflation-Protected Securities (TIPS). These securities are designed to adjust their value based on changes in the Consumer Price Index (CPI) to ensure that your investment keeps pace with inflation. Additionally, maintaining a disciplined savings and investment plan can help counter the erosive effects of inflation on your wealth over time. With the support of expert research and intuitive tools available on HDFC SKY, you can make informed investment decisions and tailor your portfolio to include inflation-resistant assets, thereby enhancing your financial resilience against the impact of inflation.

Compound Interest Calculator can be a valuable tool in planning for long-term financial growth amidst inflation. By simulating various interest scenarios, it allows you to visualize potential returns and adjust your strategies accordingly, ensuring that your investments align with inflation-resistant goals and secure your future purchasing power effectively.

Introduction to Investment Tools for Beating Inflation

HDFC SKY, an innovative offering by HDFC Securities, is designed to equip investors with a comprehensive suite of investment tools for beating inflation. In today’s dynamic economic landscape, where the purchasing power of money steadily erodes due to inflation, it is crucial for investors to seek avenues that offer returns that outpace inflation. HDFC SKY provides seamless access to a diverse range of investment options such as Indian equities, ETFs, mutual funds, IPOs, derivatives, commodities, currencies, and global stocks. By offering zero account-opening charges and a flat brokerage fee of ₹20 per order (with lifetime free ETFs), HDFC SKY ensures cost-effective investment opportunities for investors looking to combat inflationary pressures.

Moreover, HDFC SKY goes beyond traditional brokerage platforms by incorporating interest-bearing margin trading facilities, expert research insights, and intuitive tools to empower investors in making informed investment decisions. Inflation erodes the real value of investments over time, making it essential for investors to explore avenues that offer the potential for higher returns. With HDFC SKY, investors gain access to a user-friendly platform that not only facilitates trading in a wide array of financial instruments but also offers valuable research and tools to navigate the complex world of investments effectively. By leveraging these cutting-edge investment tools, investors can proactively combat inflation and strive to build a robust investment portfolio that generates returns that exceed the rate of inflation.

Leveraging Real Estate Investments to Combat Inflation

One effective strategy for combating inflation is leveraging real estate investments. Real estate is considered a tangible asset that tends to appreciate over time, often outpacing the rate of inflation. By investing in real estate, individuals can hedge against inflation as property values typically increase in value along with the rising cost of goods and services. Additionally, real estate investments can provide a steady stream of passive income through rental yields, which can be adjusted to keep pace with inflation. Leveraging real estate through mortgage financing can further enhance returns by allowing investors to benefit from the property’s appreciation while using borrowed funds to increase their purchasing power.

HDFC SKY, offered by HDFC Securities, provides an innovative platform for investors to explore various avenues for leveraging real estate investments. With access to Indian equities, ETFs, mutual funds, IPOs, derivatives, commodities, currencies, and global stocks, investors can diversify their portfolios to include real estate investment trusts (REITs) and real estate-related securities. The platform’s zero account-opening charges and flat brokerage fee per order make it cost-effective for investors to enter and exit real estate investment positions. By leveraging HDFC SKY’s expert research and intuitive tools, investors can make informed decisions on how to allocate their funds across different asset classes, including real estate, to combat inflation effectively.

Exploring the Benefits of Investing in Stocks and Equities

Investing in stocks and equities can offer numerous benefits to individuals looking to grow their wealth over time. One of the primary advantages is the potential for high returns on investment. By investing in well-performing companies through platforms like HDFC SKY, investors can take advantage of the growth potential of these businesses, which can lead to substantial gains in the long run. Furthermore, investing in stocks allows individuals to diversify their portfolios, spreading out risk and reducing the impact of market fluctuations on their overall investment.

Adani Green share price exemplifies how investing in renewable energy stocks can be a rewarding venture. As the global shift towards sustainable energy sources accelerates, companies like Adani Green are poised for growth. This sector provides investors with the opportunity to support environmentally responsible businesses while diversifying their investment portfolios effectively.

Another benefit of investing in stocks and equities is the opportunity for passive income through dividends. Many companies distribute a portion of their profits to shareholders in the form of dividends, providing investors with a regular income stream. Additionally, investing in equities can serve as a hedge against inflation, as the value of stocks tends to increase over time, outpacing the rate of inflation. With the right research, tools, and expert guidance available on platforms like HDFC SKY, individuals can make informed investment decisions and take advantage of the potential benefits of investing in stocks and equities.

Diversifying Your Portfolio with Bonds and Fixed-Income Securities

Diversifying your portfolio with bonds and fixed-income securities can be a strategic move to balance risk and potentially enhance returns. Bonds are debt securities issued by governments, municipalities, corporations, and other entities to raise capital. They offer a fixed interest rate over a specified period, providing investors with a predictable stream of income. By including bonds in your investment mix, you can mitigate the volatility of the stock market and safeguard your portfolio against economic downturns. Fixed-income securities, such as treasury bonds, corporate bonds, and municipal bonds, offer varying yields and maturities, allowing you to tailor your investment strategy to meet your financial goals and risk tolerance. HDFC SKY, with its diverse range of investment options, can facilitate easy access to a wide selection of bonds and fixed-income securities, enabling you to build a well-rounded investment portfolio.

Incorporating bonds and fixed-income securities into your investment portfolio can also help in diversifying your income sources and protecting your capital. Unlike stocks, which can be highly volatile, bonds offer a stable income stream through regular interest payments. This can be particularly beneficial for risk-averse investors looking for steady returns and capital preservation. Additionally, bonds tend to have a negative correlation with stocks, meaning they may perform well when equities are facing downturns, providing a buffer against market fluctuations. With HDFC SKY’s user-friendly platform and comprehensive research tools, investors can easily analyze and select suitable bonds and fixed-income securities to create a well-diversified investment portfolio that aligns with their financial objectives and risk profile.

Harnessing the Power of Commodities and Precious Metals

Commodities and precious metals play a significant role in diversifying an investment portfolio and hedging against market volatility. By harnessing the power of commodities such as gold, silver, crude oil, and agricultural products, investors can protect their wealth from inflation and economic uncertainties. Commodities also offer a unique opportunity to profit from global supply and demand dynamics, geopolitical events, and macroeconomic trends. HDFC SKY, with its comprehensive offering of commodities trading, provides investors with a convenient platform to access these markets and capitalize on price movements. Whether it’s trading in energy, metals, or agricultural commodities, investors can leverage the expertise and research provided by HDFC Securities to make informed decisions and optimize their investment strategies.

Precious metals, such as gold and silver, have long been regarded as safe-haven assets and store of value. In times of economic turmoil or geopolitical instability, these metals tend to perform well, making them attractive investment options for risk-averse investors. With HDFC SKY, investors can easily trade in precious metals, benefiting from their inherent stability and liquidity. The platform’s user-friendly interface and competitive brokerage rates make it convenient for investors to buy and sell precious metals, diversifying their portfolios and safeguarding their wealth. By harnessing the power of commodities and precious metals through HDFC SKY, investors can take advantage of the unique opportunities these assets offer and build a robust investment portfolio.

The Role of Cryptocurrencies in Hedging Against Inflation

Cryptocurrencies have emerged as a popular choice for investors looking to hedge against inflation. Unlike traditional fiat currencies, which are subject to inflation due to government policies and economic fluctuations, cryptocurrencies operate independently of centralized authorities. Assets like Bitcoin and Ethereum are finite in supply, with predetermined issuance limits, making them inherently resistant to inflationary pressures. This scarcity factor has positioned cryptocurrencies as a store of value that can potentially retain or increase in purchasing power over time, especially during times of economic uncertainty or currency devaluation.

HDFC SKY, offered by HDFC Securities, recognizes the growing importance of cryptocurrencies in investment portfolios. The platform’s diverse range of investment options, including Indian equities, commodities, currencies, and global stocks, now extends to cryptocurrencies to provide investors with a comprehensive hedging strategy against inflation. With its user-friendly interface, expert research tools, and competitive pricing structure, HDFC SKY empowers investors to seamlessly access and manage their cryptocurrency holdings alongside traditional assets, offering a modern and efficient way to navigate the evolving landscape of financial markets.

The stock trading app enhances the investment experience by integrating cutting-edge technology and comprehensive market access. It simplifies the process for users to diversify portfolios with real-time data and analytics. This app supports informed decision-making, allowing investors to confidently embrace new opportunities in the financial markets.

Utilizing High-Yield Savings Accounts and CDs for Financial Growth

High-yield savings accounts and certificates of deposit (CDs) are valuable tools for individuals seeking to grow their finances steadily and securely. High-yield savings accounts typically offer higher interest rates compared to traditional savings accounts, allowing account holders to earn more on their deposits. These accounts are easy to access, offer liquidity, and are typically insured by the Federal Deposit Insurance Corporation (FDIC) in the United States, providing an added layer of security. Additionally, some high-yield savings accounts have no monthly maintenance fees, making them a cost-effective option for individuals looking to grow their savings without incurring unnecessary charges.

Certificates of deposit (CDs) are another popular option for individuals looking to maximize their financial growth. CDs offer fixed interest rates for a specified period, ranging from a few months to several years. This fixed rate ensures a predictable return on investment, making CDs a low-risk option for individuals seeking stable growth. While CDs typically have penalties for early withdrawal, they are a great tool for individuals looking to set aside funds for a specific financial goal or to diversify their investment portfolio. By leveraging the benefits of high-yield savings accounts and CDs, individuals can effectively grow their finances while minimizing risks.

Developing a Comprehensive Wealth-Building Plan with Inflation in Mind

In today’s dynamic financial landscape, it is crucial to develop a comprehensive wealth-building plan that takes into account the impact of inflation. HDFC SKY, offered by HDFC Securities, provides a modern discount-broking platform that empowers investors to navigate the complexities of the market effectively. By offering seamless access to a wide range of investment options such as Indian equities, ETFs, mutual funds, IPOs, derivatives, commodities, currencies, and global stocks, HDFC SKY enables investors to diversify their portfolios and mitigate the risks associated with inflation. With features like zero account-opening charges, flat ₹20-per-order brokerage, lifetime free ETFs, interest-bearing margin trading, expert research, and intuitive tools, investors can make informed decisions to protect and grow their wealth in the face of inflationary pressures.

As inflation erodes the purchasing power of money over time, having a well-rounded investment strategy is essential for wealth preservation and growth. HDFC SKY provides investors with the tools and resources needed to stay ahead of inflation by offering competitive brokerage rates, access to a wide array of investment products, and expert research insights. By leveraging the platform’s user-friendly interface and comprehensive range of services, investors can create a diversified portfolio that hedges against inflationary risks. With HDFC SKY, investors can proactively adjust their investment allocations, explore alternative asset classes, and capitalize on emerging opportunities to build wealth that withstands the effects of inflation over the long term.